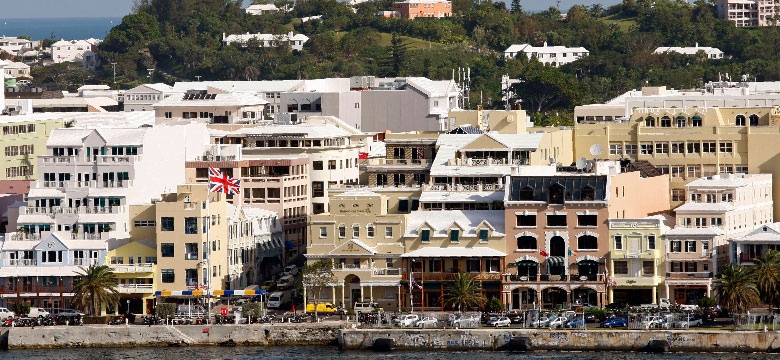

HAMILTON, BERMUDA – The Financial Policy Council (FPC) held its thirteenth meeting on 30 April 2020 via teleconference. All members were able to participate on the call.

The focus of the meeting was a discussion of the potential threats to Bermuda’s financial stability emanating from the COVID-19 pandemic. It involved a continuation of a dialogue that began during a special FPC teleconference held on 10 April. This discussion on 30 April included the participation of Mr. Philip Butterfield, Chairman of Bermuda First and Mr. Jonathan Portes, Chairman of Bermuda’s Fiscal Responsibility Panel.

The meeting acknowledged that objectives both in terms of a rapid and robust response to the emergency in the short term, and the development of policies to minimize the economic and social impact of the COVID-19 pandemic in the longer term were clear. In that context, FPC members began their discussion by commending the Bermuda Government, all of its health workers and critical service providers for the determined and courageous manner in which they were working to contain the virus. Members strongly supported the immediate channeling of economic resources that had taken place to support health care system and the critical services at this time. The Shelter-in-Place order and other policies to limit the spread of the virus was the first main priority for the Government at this time.

With regard to the immediate responses to the economic impact of the COVID-19 pandemic, FPC members welcomed the various economic emergency initiatives underway by the Bermuda Government. Members expressed support for the government’s support of individuals and businesses affected by the pandemic, in particular the implementation of an unemployment benefit programme as well as the support for the small- and medium-sized business sector that is being carried out in coordination with Bermuda Economic Development Corporation. FPC members, however, noted that it would be important to ensure that policies such as getting credit into the economy, the delivery of which is dependent on private parties such as the banks, are delivered effectively and in a spirit of consensus.

Members predicted that, like every major economy, Bermuda’s economy would be significantly damaged by the global pandemic, experiencing a major drop in GDP, increasing unemployment as well as a deterioration in the fiscal accounts. Moreover, Bermuda was particularly vulnerable because of the openness of its economy, its dominant international business sector, and the important role in economic activity of foreign exchange receipts and employment resulting from travel and tourism. Given the seriousness of the matter, members welcomed the comments from the Government that an ambitious and significant set of economic measures were being developed to effectively respond to the economic threats posed by the pandemic.

With this in mind, the members discussed the important ingredients of cohesive plans to address the longer-term challenges given the undoubted impact that COVID-19 will have over the years ahead. Members were pleased to note that starts had been made in respect of each of the main ingredients of such planning for the future.

Firstly, the FPC noted that such plans would need to include a review of a thorough and rigorous set of scenarios. These would inform prioritization of possible measures needed to mitigate the impact – and to develop new opportunities - on the key areas of travel and tourism on the one hand, and the international business community on the other. These two sectors, duly enhanced by further opportunities from Fintech, and the acceleration of digital activity encouraged by the COVID event, provide the great bulk of the necessary foreign exchange on which the future stability of the economy depends.

The second major dimension to such plans will be the importance to ensure that measures needed both to mitigate threats to tourism and travel, and to facilitate opportunities for development of international business should be addressed. It was noted that addressing areas in the past such as a revision of residency rules and immigration policies had appeared difficult. These are however, important success factors, and it was to be hoped that the existential issues arising from the crisis would unlock the key to addressing such issues immediately.

It was also noted that making changes and adjustments to meet threats and respond to opportunities would, as in other jurisdictions require a willingness to think out of the box about processes to get things done quickly. FPC members noted that established practices typically work well in normal times but can often fail to deliver in times of existential threat.

Thirdly, an important emphasis would be necessary with respect to developing financing plans to cater for a variety of possible outcomes including both domestically as well as internationally. It was clear to members that a start had been made in this respect. The impact of COVID-19 on Government finances, both in terms of unexpected expenditure and decreased revenues, would however require an immediate review of the Government budgets and external borrowing requirements. Bermuda may currently be well positioned in international capital markets for any new debt issuance, but any such initiative will need to be underpinned by the credibility of its actions and plans to assure lenders.

Lastly, the importance of an effective communication plan covering all the aspects of such forward thinking was clearly essential as emergence from the immediate crisis takes place.

Members shared the concerns expressed in Bermuda of the particular challenges being faced by one particular aspect of the plans namely Bermuda’s tourism and travel sector. The immediate impact had been devastating and the near term outlook highly clouded by uncertainties. Many

issues for the tourism sector lay beyond the control of Bermuda, and would need active participation by Bermuda in developing necessary protocols for international travel to reassert confidence.

In addition to lengthy discussion of the economic and fiscal impact of COVID-19 on the Bermuda economy, the following topics were discussed:

● Recent developments in relation to Fintech, in particular developments related to stablecoins and central bank digital currencies (CBDC) under review in other countries,

● Work in progress with respect to engagement by Bermuda on tax matters in relation to initiatives in place at the OECD and the European Union

● Recent work underway at the Bermuda Government and the BMA in respect to continuing with the development of a recovery and resolution framework for Bermuda banks

The next formal meeting of the FPC is scheduled for July 2020.