UK legislation in the House of Lords that would have forced Bermuda to make public a long standing register of corporate beneficial owners, has been withdrawn.

Bermuda is the only country known to have an up-to-date register detailing the ultimate owners of its registered companies, maintained for more than 70 years.

Local officials provide the information to authorities of other governments by request.

The call in Britain is for every country to have such a register, but that it be open to the public. Bermuda is willing to conform, but only if it becomes the world standard.

As the only jurisdiction with a long-standing up-to-date list, it would be disadvantageous for Bermuda to be forced to make its register public, before other jurisdictions comply.

This week's legislation was a proposed amendment to the Criminal Finance Bill before the legislature, which would have attempted to force compliance from Bermuda and five other Overseas Territories.

The proposal was eventually withdrawn in favour of a government amendment requiring UK authorities to report on the effectiveness of beneficial ownership information sharing between the UK and Overseas Territories by July 2019.

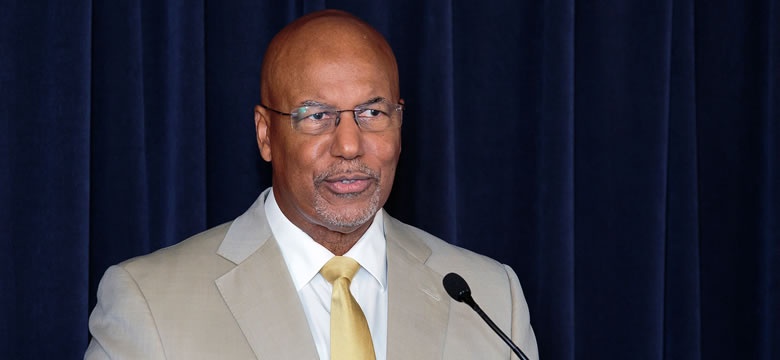

Deputy Premier and Minister of Finance, the Hon. E.T. Richards JP MP, said, "This is a good day for Bermuda. I am pleased that we have won this battle, although I can expect that this issue will return again.

"While the UK has indicated that it will implement its own beneficial ownership list of British companies and make it public, they are at the beginning of the process that we've had in place for several decades. It would have been detrimental to Bermuda's international business to be the only country with a complete register and be forced to make it public. Few other countries have registers of any kind. Bermuda is a leader in the issue of beneficial ownership and continues to comply with global standards."

"The Ministry of Finance team and our office in London have been successful over several years informing UK legislators and others of the true facts related to issues that threaten our business. The Bermuda Monetary Authority and the National Anti-Money Laundering Committee have also been integral to our cross-border outreach."

The London office collaborated with other OT UK Representatives and officials within the UK Government, working in strategic partnership to address the Amendment. Support was derived from Home Office Ministers Baroness Williams and Ben Wallace which led to the British Government's successful alternative Amendment.

The Criminal Finance Bill was a priority of the UK Government in tackling financial crime. Bermuda and both sides of the UK Parliament welcomed the passage of the legislation through both Houses of Parliament.

During the debate, the Earl of Kinnoull spoke highly of the BMA and Bermuda as a reinsurance centre.